unrealized capital gains tax warren

Warrens wealth tax would apply a 2 percent tax to individual net worth including the value of stocks houses boats and anything else a. What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans.

Elizabeth Warren S Wealth Tax Would Hurt More Than Just The Tippy Top

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

. I think before we dive into our next question we do have a couple of questions in Slido from the last hour. For the owner this unrealized capital gain would be taxed under Sen. That wealth tax that ms.

Posted on November 7 2019 by Dan Mitchell. Instead an asset sold for a gain would be subject to capital gains tax plus a deferral charge meant to replicate interest payments on taxes that went unpaid each year together totaling a tax. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

This tax is just the latest attempt by the Democrats to reshape the tax code and pass a tax on unrealized gains. The same for Tesla and Square and many others. Tax capital gains at ordinary income rates and raise those rates to pre-Tax Cuts and Jobs Act TCJA levels.

An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind. Warrens proposed mark-to-market taxation of capital gains at ordinary income tax rates which means that the billionaire pays taxes on the capital gains each year whether or not they sell the asset. Raising the rate is not going to cause Jeff Bezos to pay a penny more.

Last month I accused Elizabeth Warren of being a fiscal fraud for proposing a multi-trillion dollar government takeover of healthcare. Thats the attitude at least of some progressive lawmakers like Elizabeth Warren and Alexandria Ocasio-Cortex AOC who famously wore a dress to the Met Gala with Tax the Rich emblazoned on it. The tax would apply to 1 million of that 2 million gain due to the exclusion.

This tax called a billionaire minimum income tax would impose an annual 20 percent tax on taxpayers with income and assets that exceeding 100 million a 360 billion tax increase. Is expected to lose almost 42 billion in tax revenue. After all as is explained in the New York Times.

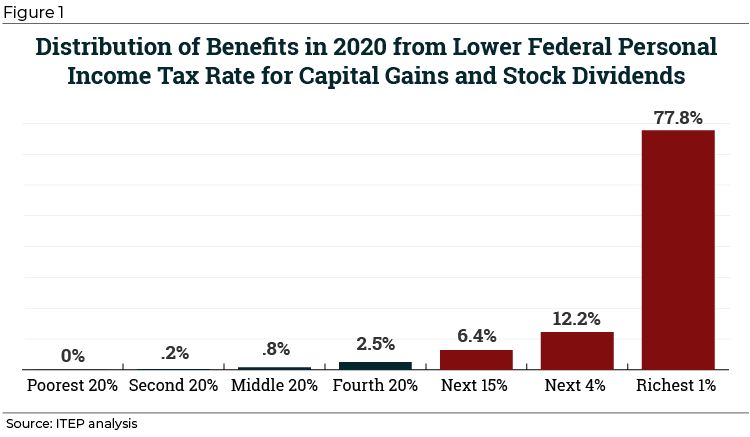

And Senator Elizabeth Warren pushed a more sweeping version of an unrealized capital gains tax during her presidential run. Scrapping that tax on unrealized capital gains would primarily benefit the richest Americans who hold the bulk of the countrys financial. Senator Warrens Nutty Idea to Tax Unrealized Capital Gains.

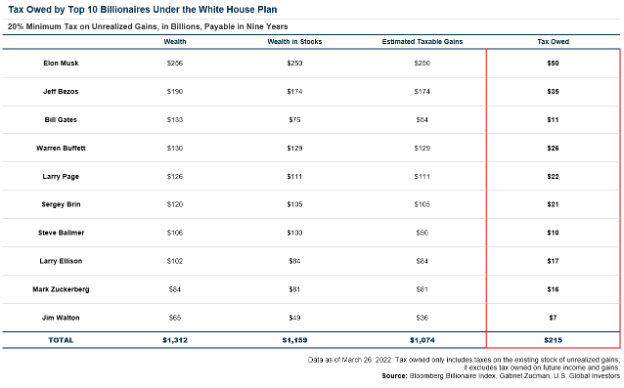

Every other tax that has been challenged on these grounds has been upheld. Warren talked about during her presidential campaign would have applied to all assets held by the wealthy. Below are one economists estimates of what the top 10 wealthiest Americans would owe on their unrealized capital gains alone.

30 2021 Published 1040 am. Thus gains would be taxed at a. An attempt to tax unrealized capital gains was struck down in the Macomber case of 1920.

Democrats seem to have nixed the idea of taxing returns on unsold stock and other assets favoring other ways to raise revenue as part of a nearly 2 trillion social and climate bill. This new tax is similar to the wealth taxes pushed by radical. Michael Saylors publicly-held company MicroStrategy is currently sitting on unrealized gains of over 2 billion from its bitcoin stack.

Global asks Democrats are trying to pass a bill to tax unrealized. Stocks collectibles real estatecurrently taxpayers only pay the capital gains tax when an asset is sold. For tradable assets such as stocks billionaires would pay capital gains tax currently 238 on the increase in value and take deductions for losses annually.

In total 215 billion could be collected over nine years with Musk paying the most at 50 billion. Billionaires would pay a 238 tax on unrealized gains in the value of their public stocks. Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIsthe Elon.

Billionaires tax would take aim at unrealized gains on assets most profitable corporations Democrats hope to generate at least 200 billion in new revenue over the next decade from the tax. When a permanent income tax was introduced after the. There is a chance that Senator Warrens proposed wealth tax would be found unconstitutional but opinions are mixed and the precedents go both ways.

She then unveiled a plethora of class-warfare taxes. Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIsthe Elon Musks and Mark Zuckerbergs. Currently the tax code stipulates that unrealized capital gains arent taxable income.

Presidential candidate Elizabeth Warrens tax proposals would push federal rates on billionaires and some multimillionaires above 100 to.

Will The Unrealized Capital Gains Tax Proposal Apply To Most Investors The Motley Fool

Warren S 2 Cents Will Prove Costly For All Wsj

An Unrealized Capital Gains Tax Would Wallop Big Stock And Bitcoin Investors Nasdaq

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption

Opinion Elizabeth Warren S Wealth Tax Might Sound Like Nothing But The Numbers Aren T Small The Washington Post

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Warren S Wealth Tax The Return Of Feudalism The Capital Note National Review

Serge Egelman On Twitter If You Can Use Unrealized Capital Gains As Collateral For A Loan A Reasonable Person Should Conclude That Those Gains Have Effectively Been Realized This Is An Area

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Unrealized Capital Gains Tax Explained

The Unintended Consequences Of Taxing Unrealized Capital Gains Usgi

Unrealized Capital Gains Tax Explained

Taxing Unrealized Capital Gains A Bad Idea National Review

Unintended Consequences Of Taxing Unrealized Capital Gains Investing Com

Dems Latest Idea To Fund Their Spendapalooza As Desperate As It Gets